The United States’ hands-off’ method of dealing with gas inflation places is ineffective

By Andreu Beltran ’25

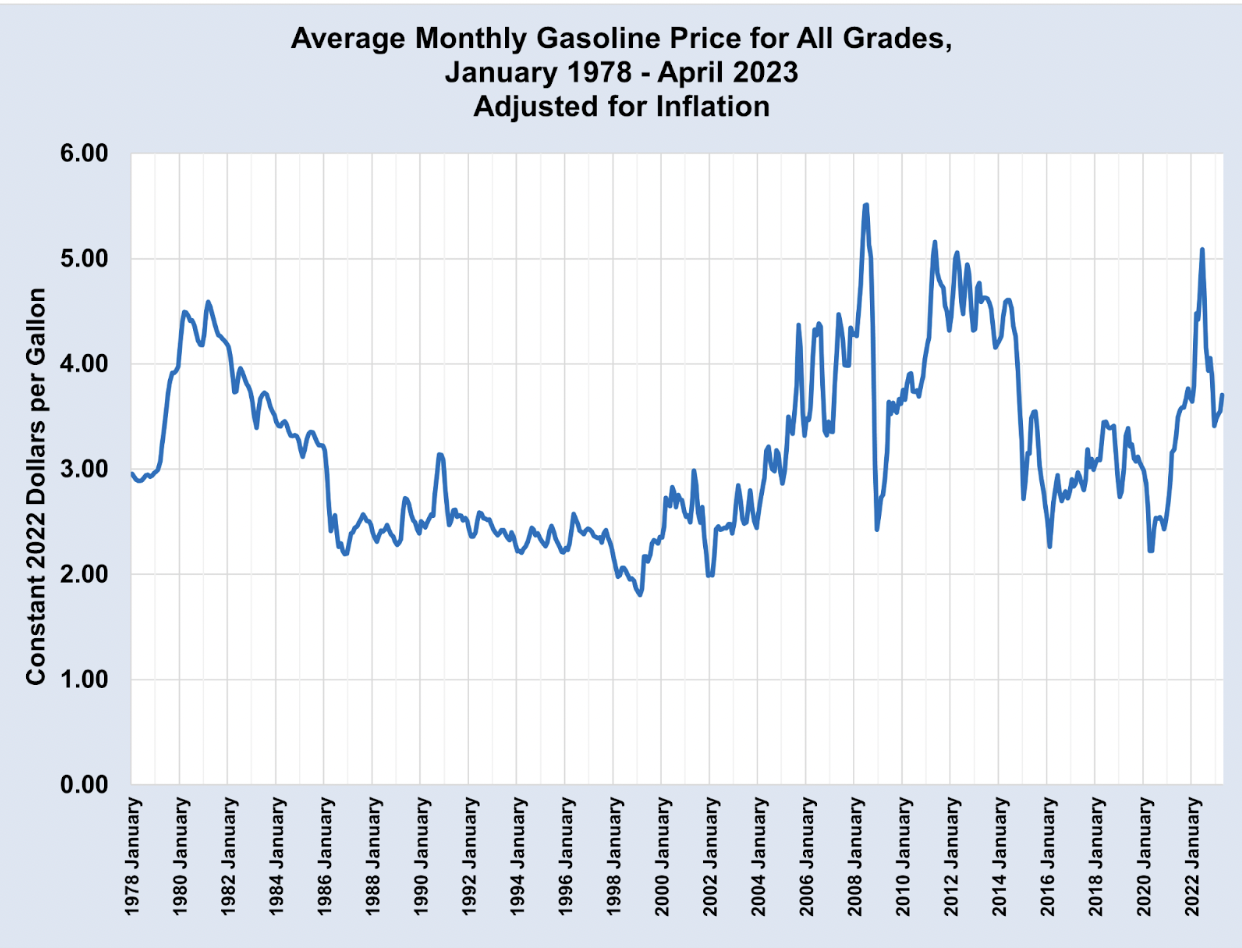

There has been a gas shortage in the United States mainly because the Middle East is unable to supply it. However, as the United States’ need to depend on the East decreases, its demand for gas increases, which is evident in its rising prices. The issue has been particularly prevalent recently, with gas reaching an unprecedentedly high price of $3.85 per gallon in August. The White House has been a bystander on this issue because their plan to deal with soaring costs is to simply “wait and see.” However, U.S. gas prices likely will not drop for years because of economic strains across the globe, such as war, workers’ unions, and the United States’ lack of oil refineries.

Because the United States does not produce its own oil and depends on unreliable countries, it cannot expect to find the oil needed to match rising demand. During the Russian-Ukrainian war, the West placed a trade embargo on Russia and, therefore, will not take their imports anymore. While Vladimir Putin has caused millions of deaths, and a trade embargo could motivate him to recall troops, this could have been the wrong move. The United States automobile industry is expanding, and thus, so is the demand for oil. However, with the recent embargo, Russia, one of the U.S.’s primary suppliers, will no longer be able to provide the necessary oil. Russia, in particular, was a valuable asset to the oil market, producing one-tenth of the world’s supply of oil prior to the Russian-Ukrainian War. For the United States, 8% of all petroleum imports came from Russia in 2021 before the trade ban. Because of the Western ban on trade with Russia, the United States supply is currently much lower than its demand. By “waiting and seeing,” the United States is turning a blind eye as it loses its primary sources of oil, only prolonging the issue of gas inflation.

Other countries will never meet the United States demand for oil because their country is in constant danger of worker strikes. Iran, for example, is a large producer of oil, but their unpredictable market leads to lots of inflation, debt, and discontent among the working class. As a result, workers in the oil industry went on strike in April of this year, calling for a 79% increase in their wages. While, at first glance, the easy solution to this problem would be to satisfy the workers’ demands, Iran’s economic depression makes these actions virtually impossible: the president could only supply a 27% increase and a promise to curb inflation during 2023. The worker strike in Iran proves the nation is not dependable for oil because it is in an economic crisis. Norway, another major producer of oil, also suffers from worker strikes that could cost the country 8% of its oil output. Discontent among oil drillers in these countries results in the working class being unmotivated to increase oil production. These countries are unlikely to be able to satisfy the working class because they do not have the funding; the only possibility is foreign intervention from a country like the United States, which contradicts the idea of the United State’s current method of “waiting and seeing.” The sheer poverty in the countries makes the chances of ever meeting the national demand for oil slim.

Lastly, the United States will continue to struggle to level out gas prices because it does not have sufficient oil refineries. The process of refining oil is becoming more expensive as a result of COVID-19 since, at the height of the pandemic, six refineries in the United States shut down, resulting in a net loss of 750,000 barrels per day. Due to natural disasters and lackluster technology, the refineries that still exist struggle to get work done fast enough to keep up with demand. As demand continues to exceed supply, gas prices will undoubtedly continue to rise. According to the United States Energy Information Administration, 26% of the consumer cost of gas comes solely from the cost of refining oil. Thus, the cost of refining oil is unlikely to go down any time soon without government intervention.Wallet Investors predicts that gas prices will rise to a little under $5 per gallon in the next five years or by the beginning of 2028. No matter what the White House does to remedy gas inflation, this projection proves that the country will take a massive hit from gas inflation. Investors will be hesitant to pour money into the oil industry because it is not very dependable, and the consumers will lose more and more money as prices hike. The ever-intensifying problems with foreign oil suppliers and oil refineries will prevent the national oil supply from ever becoming more stable on its own if the White House decides to ‘wait and see.’ At some point, the United States will need to lend a helping hand to foreign countries so that it can stabilize its own economy.